The trader spoke about the probability of a new wave of bitcoin prices

Forecasts of financial markets are the private opinion of their authors. The current analysis is not a guide to trade. FORKLOG is not responsible for the results of the work that may arise when using trade recommendations from the presented reviews.

A practicing trader and founder of the Crypto Shaman project Vadim Shovkun talks about the current situation on the market.

S&P 500

In the stock market, the situation continues to take shape negatively: the entire rebound is absorbed in the seller, and no volumes arose. Any serious rebound or growth is not yet expected.

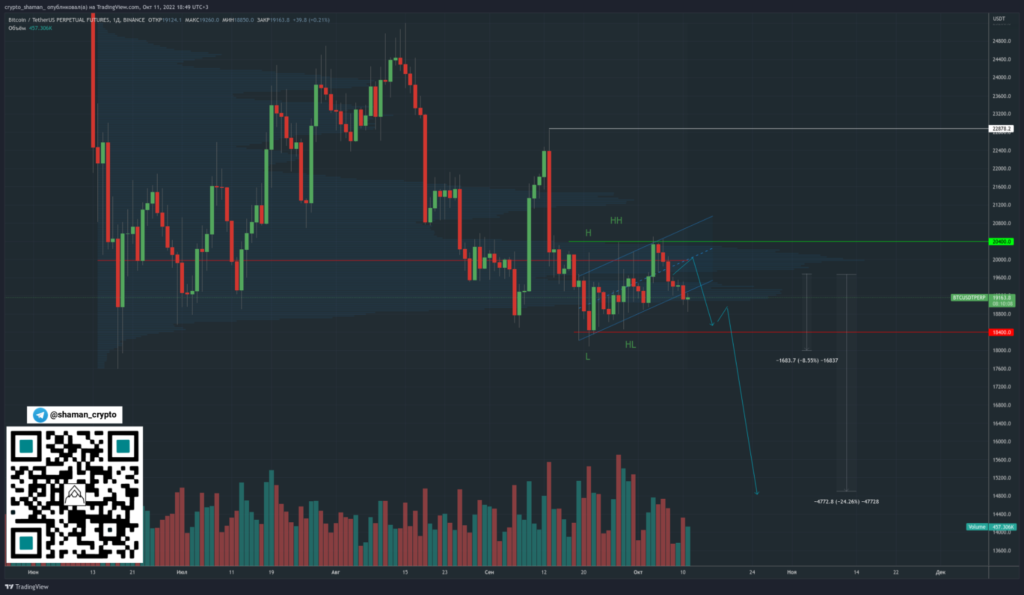

Bitcoin

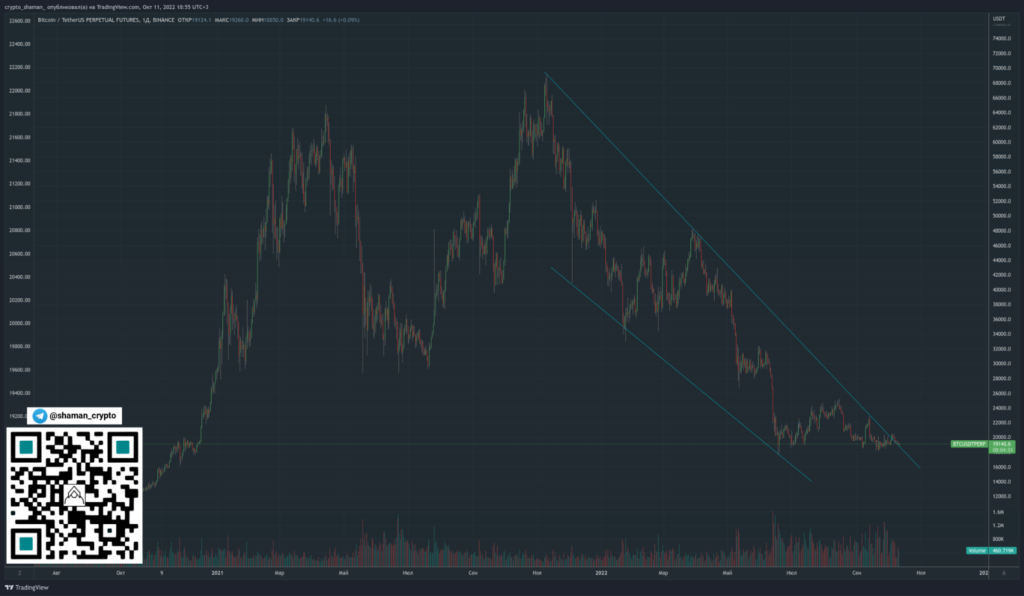

Digital gold quotes have decreased significantly, the entire impulse last week has been absorbed. Canaan quarterly At the same time, the price is trying to get out of the descending channel.

While Bitcoin moves within the framework of $ 18 400-20 400, the movement should be perceived as a flash, with a likely exit from the side of the side.

At the daily timeframe, the price could not gain a foothold on the trend line, drawing a new wave of reduction.

According to the analysis of market sentiments, recently there was a surge of people who wanted to buy cryptocurrency on social networks.

A slightly different situation in relation to those who want to sell:

Useful observations can be extracted from the schedule of liquidation analysis over the past week and for a four -month -old schedule.

Over the past three months, there have been 10 short-circuiting and 10 long-lords above 2400 BTC. The total long-long-lords are slightly larger (according to the number of contracts). There are also more peak bursts of Long liquidation (noted above 3600 BTC).

Last week there was a short-term update of maximum sides $ 18 400-20 400. At the same time, the number of liquidated shorts is minimal, although there was a lot of liquidity in the field of $ 20,400.

conclusions

Buyers prevail in the market with a slight advantage. This can be seen from the liquidation schedule, according to the moods on social networks.

The context of technical analysis shows that the price has come out of the ascending channel and is pressed to the liquidity cascade of $ 18 400-17 600.

Analysis of the stock market also does not inspire confidence in serious growth. This week (Thursday-Friday), a large number of reports of companies should be released, which with a high probability will negatively affect the mood of investors. Respectively, on bitcoin.

Read the FORKLOG Bitcoin News in our Telegram-cryptocurrency news, courses and analytics.